Picking a finance tool shouldn’t feel like guesswork. fintechzoom com brings research, context, and usability together so you can move from headlines to decisions in minutes. It works as a financial news site for investors and a market data portal for U.S. traders, giving you fast quotes, clean charts, and plain‑English explainers. You’ll also find a stock and crypto information hub with smart filters, technical and fundamental screeners for idea discovery, and market alerts and watchlists to catch catalysts on time.

In this guide, you’ll see what the platform does well, how its data and methodology are structured, and when to pair it with other tools. We’ll cover security, U.S. compliance, and practical playbooks for stocks and crypto, so you can build a routine that actually sticks. If you want a clear, Google‑friendly blueprint for research, you’re in the right place—let’s get started.

Explore More Topic: Depomin82

FintechZoom.com at a Glance (What It Is, Who It’s For)

Here’s the short version in plain English: fintechzoom com is a financial news site for investors that bundles quotes, charts, and explainers into one place. It works like a market data portal for U.S. traders, so you can scan movers, earnings, and headlines quickly. Think of it as an investment research platform overview you can actually use daily—an organized stock and crypto information hub with context instead of noise. It also doubles as an investor education resource (USA) so newcomers learn the basics without getting overwhelmed.

In practical terms, you’re looking at a financial information website that gathers market signals and editorial insights in one view. The aim is to be an independent research provider, not your broker. It functions as a data aggregation platform and makes the research vs brokerage distinction crystal clear. It’s informative but not an order‑execution service, so you research here and place trades with your broker or exchange.

Research vs Brokerage—what to use when (U.S. context):

| Task | Use a Research Platform | Use a Brokerage/Exchange |

|---|---|---|

| Scan premarket/after‑hours moves, news, and calendars | Yes—research and plan | Not needed for research |

| Build watchlists and screeners; compare tools and fees | Yes—evaluate options | Research first, trade later |

| Place orders, fund accounts, manage positions | Research only | Yes—execution and custody |

Quick example: Before the open (ET), review premarket movers and the economic calendar, add tickers to a watchlist, then switch to your broker to execute. Research lives in one tab; trading in another.

What Is FintechZoom.com?

If you want a finance content platform definition, here’s the simple one: it centralizes news, data, and tutorials so you can research faster. You get multi‑asset market coverage across stocks, ETFs, and digital assets with equities and digital assets insights in one view. Macro days feel less chaotic because macroeconomic news and analysis sits beside charts, calendars, and explainers. A brief editorial and data tools overview shows you where to find watchlists, screeners, and educational pieces.

Under the hood, it follows a financial publishing model with a clear coverage scope (stocks, ETFs, crypto). The site nudges you through research workflows explained step by step—from reading a headline to validating it on a chart. Navigation reflects a site architecture for investors with hubs for assets, sectors, and themes. Smart content taxonomy and tagging keep related articles, tickers, and guides connected so you don’t get lost.

How a typical research session flows (example):

Check macro page for the day’s print (CPI, jobs, FOMC) and related sectors.

Open a ticker page to review price action, news, and fundamentals.

Save to a watchlist and set alerts for key levels or events.

Who Benefits Most (Beginners, Active Traders, Long‑Term Investors)

This platform is designed around investor personas and use cases, so each type of reader gets what they need without friction. Beginners get beginner investing resources USA that explain terms and show simple flows. Short‑term traders get a day trading research toolkit that surfaces movers, catalysts, and volatility. Long‑horizon readers use long‑term portfolio tracking to monitor holdings and explore retirement‑focused research needs like dividends, drawdowns, and rebalancing.

Workflows are tailored by suitability by experience level and risk tolerance alignment, which helps reduce avoidable mistakes. You can do investor goals mapping to match tools with your time horizon. The interface balances research depth for pros vs novices, so advanced users dig deeper while new users stay on rails. Everything supports an education path for U.S. readers that emphasizes clarity and repeatable routines.

Who gets what—at a glance:

| Persona | What They Use First | Why It Helps |

|---|---|---|

| Beginner | Glossaries, “how‑to” guides, starter watchlists | Confidence and structure on day one |

| Active trader | Movers, events calendar, alerts | Fast catalyst scanning and risk prep |

| Long‑term investor | Fundamentals, sectors, dividend tools | Thesis building and ongoing monitoring |

Quick Take

executive summary bullets: Research here; execute elsewhere. It’s for people who want key takeaways for investors without wading through jargon.

one‑minute overview: Strong data organization and news context, with a pros and cons summary that skews positive for research‑first readers.

skim‑friendly highlights: top reasons to use platform include speed, clarity, and breadth; charting and alerts support planning.

fast decision cues: If you need a quick verdict for traders, it’s a planning hub, not a trading ticket—great for prep, not execution.

alternative options at a glance: If you only need execution, pick a broker or exchange; this section gives a snapshot of strengths and gaps so you can pair tools smartly.

Key Features & Tools (Real‑Time Data, Analytics, Reviews)

If you want a fast, all‑in‑one research hub, fintechzoom com keeps the essentials in view without the clutter. You get live market coverage that pairs headlines with price and volume so context is never a click away. Powerful technical and fundamental screeners help you filter noise and surface ideas built on data, not hunches. Independent platform reviews and ratings make comparison shopping easier, while market alerts and watchlists turn plans into action. Everything sits on research dashboards for U.S. markets that highlight Wall Street hours, earnings weeks, and economic prints in Eastern Time.

Speed and clarity matter when markets move. That’s why the site emphasizes latency and refresh frequency so you know how “live” your feed really is. Layout choices focus on user workflow optimization—less hopping between tabs, more decisions in one place. A built‑in feature comparison checklist helps you see what tools you have and what you still need. Clean menus and readable charts support an investor‑friendly interface, and section headers reveal the depth of coverage by asset class at a glance.

Feature ➜ Why it matters (quick view)

| Feature | Investor Benefit |

|---|---|

| live market coverage | See price + news together to avoid blind spots |

| technical and fundamental screeners | Build repeatable filters for setups and quality |

| platform reviews and ratings | Choose tools confidently without overpaying |

| market alerts and watchlists | Stay proactive on levels, events, and catalysts |

| research dashboards for U.S. markets | U.S. hours, filings, and macro context in one view |

Real‑Time Market Intelligence & Alerts

Real‑time means more than green and red ticks. You’ll find intraday quotes and news tied to catalysts, so headlines and charts tell the same story. Before the bell, premarket and after‑hours tracking shows where flows are building. During the session, U.S. index movement updates help you map breadth and leadership. If you trade digital assets, crypto price monitoring keeps pairs and dominance on your radar. A calendar view pushes economic calendar notifications so you prep for CPI, NFP, and FOMC instead of reacting late.

Alerts are only useful when they’re precise. Set push alerts for price thresholds to ping you at key supports, resistances, or VWAP touches. Stream real‑time headlines parsing to spot catalysts faster and filter by symbol or sector. Use volatility spike detection to flag unusual ranges and spreads. Build event‑driven trading signals around earnings times or economic releases. Check the refresh cadence (seconds/minutes) for each module so you know which tiles update tick‑by‑tick and which refresh on intervals.

Popular alert types (examples you can copy):

| Alert Type | Sample Trigger | Why It Helps |

|---|---|---|

| push alerts for price thresholds | “AAPL crosses $200 ±$0.10” | Focus on inflection points, not noise |

| real‑time headlines parsing | “$TSLA + ‘delivery’ within 1 min” | Catch catalyst language immediately |

| volatility spike detection | “ATR 5‑min > 2× 20‑day avg” | Avoid surprise whipsaws |

| event‑driven trading signals | “Earnings in 30 min” | Prep plan and size before the print |

| refresh cadence (seconds/minutes) | “Tile updates every 15s” | Align expectations with data freshness |

Professional‑Grade Analytics & Screeners

Serious research needs serious tools. Start with technical indicators (RSI, MACD) to frame momentum and mean reversion. Layer factor and sector filters to isolate quality, value, or growth inside specific industries. Sort by market cap tiers and liquidity to prevent slippage from killing otherwise good ideas. Explore backtesting and strategy ideas to sanity‑check rules before you risk a dollar. Round it out with earnings and valuation metrics so narratives meet numbers.

Screeners shine when they’re flexible. Build custom screener presets you can reuse across watchlists. Combine multi‑criteria filters like valuation bands, margin trends, and price action states. Use risk‑adjusted screening so Sharpe‑like metrics and drawdowns guide selection, not just raw return. Flip to historical performance views to see how a basket behaved in prior cycles. When you like what you see, save and share screen setups with teammates or future‑you.

Sample U.S. dividend growth screener (starter recipe):

| Filter | Example Setting |

|---|---|

| factor and sector filters | Non‑cyclical sectors (Staples/Healthcare) |

| earnings and valuation metrics | 5‑yr EPS CAGR > 8%, Forward P/E < sector median |

| market cap tiers and liquidity | Mid/Large‑cap, avg volume > 1M |

| technical indicators (RSI, MACD) | RSI 14 between 45–60, bullish MACD cross |

| historical performance views | Held up vs S&P during last 3 drawdowns |

Unbiased Platform & Product Reviews

Choosing tools shouldn’t feel like guesswork. Independent broker and exchange evaluations break down strengths and trade‑offs in plain language. Clear feature‑by‑feature comparisons show where a charting app or data feed excels and where it lags. Transparent pricing and fee breakdowns keep total cost of ownership in view, including data add‑ons. Roundups include beginner‑friendly platform picks for simple starts and advanced trading tool assessments for power users.

Trust comes from process, not adjectives. An editorial independence policy separates revenue from recommendations. You’ll see testing methodology explained so results are reproducible. Summaries include pros/cons of major platforms with measurable criteria. Cards use best‑for use case labeling like “best for options backtesting” or “best for mobile charting.” Every score ties back to hands‑on review criteria such as data depth, reliability, UI, and support response times.

Review rubric (what’s scored and why):

| Criterion | What We Check |

|---|---|

| feature‑by‑feature comparisons | Charting, screeners, news, API, paper trading |

| pricing and fee breakdowns | Base tiers, data packages, hidden costs |

| hands‑on review criteria | Setup time, stability, learning curve |

| best‑for use case labeling | Beginner, swing, pro, crypto‑first |

| editorial independence policy | Disclosures, affiliate handling, updates cadence |

Infrastructure & Performance

When news hits, weak plumbing fails first. That’s why we look for uptime reliability and SLA commitments that keep research online when you need it most. Low lag is essential, so low‑latency data delivery and resilient pipes help tiles stay current. A modern CDN and caching architecture speeds charts and images across the U.S. backbone. True continuity requires redundancy and failover design across regions, not just one big server. Finally, surge traffic resilience handles the flood during earnings and macro shocks.

Performance is more than a fast homepage. Real trust comes from platform stability under volatility backed by stress‑tests. Ask to see load testing benchmarks that simulate peak sessions. Network‑level DDoS protection measures keep bad traffic out so real users stay connected. A transparent cloud hosting stack overview clarifies who runs what, where, and how failovers trigger. Continuous performance monitoring alerts help engineers fix issues before you feel them.

Operational metrics worth tracking (vendor scorecard):

| Metric | Target / Question |

|---|---|

| uptime reliability and SLA | ≥99.9% monthly, credits for misses |

| low‑latency data delivery | Sub‑second ticks on priority feeds |

| CDN and caching architecture | Multi‑edge, image and JSON caching |

| redundancy and failover design | Active‑active across regions |

| surge traffic resilience | No throttling at 5× baseline traffic |

| load testing benchmarks | Public scenarios + pass/fail |

| DDoS protection measures | Layer 3/4 and 7 coverage |

| cloud hosting stack overview | Regions, providers, data residency |

| performance monitoring alerts | 24/7 paging with on‑call SLOs |

Bottom line: Use live market coverage to spot catalysts, lean on technical and fundamental screeners to build a repeatable edge, and rely on platform reviews and ratings to assemble your toolkit wisely. Tie it together with market alerts and watchlists on research dashboards for U.S. markets, verify latency and refresh frequency, and keep a simple feature comparison checklist handy. The result is an investor‑friendly interface that respects your time and scales with the depth of coverage by asset class you need.

Markets Covered & How the Data Works (Methodology You Can Trust)

When you research on fintechzoom com, you want to know where the numbers come from and how they’re stitched together. That’s why the platform leans into methodology transparency and shows its pipeline end to end. You’ll see the data sources and provenance, the calculation methods explained, and clear coverage universe definitions for each market. Every module is tagged with delayed vs real‑time labeling and documented update intervals by asset class, along with the quality assurance checks used to keep errors low. You also get frank limitations and caveats plus practical data interpretation guidance so you don’t over‑trust any single metric.

Think of the data stack like a supply chain. Prices and fundamentals arrive from vetted vendors, pass through reconciliation and error handling, and are published when they meet internal thresholds. If a feed drops or looks off, failovers and audits kick in before values hit your screen. That clarity helps you read markets with confidence and avoid surprises on busy days.

Markets covered at a glance

| Coverage | What’s included | Timeliness label | Notes you’ll see |

|---|---|---|---|

| U.S. equities & ETFs | Quotes, fundamentals, filings, events | delayed vs real‑time labeling | Corporate actions, earnings windows |

| Indices | Major U.S. benchmarks, sector & factor sets | Real‑time or delayed by vendor | Method set + coverage universe definitions |

| Crypto | Spot prices, market cap tiers, dominance | Streaming where available | Venue list + calculation methods explained |

| Macro | Economic prints, calendars, summaries | Event‑time stamps | Source citation + limitations and caveats |

How Crypto Market Cap Is Tracked

Crypto metrics start with first principles. Market value uses a market cap calculation formula of price × supply, but the platform distinguishes circulating supply vs fully diluted so you can compare like for like. Prices use price aggregation across venues with VWAP and liquidity weighting to reduce outliers and thin books. Coverage notes include stablecoin and DeFi inclusion rules and exchange selection criteria for transparency. Odd prints face anomaly and outlier handling, including wash‑trading mitigation notes before data is published.

The universe changes fast, so taxonomy matters. Assets can move categories via a token reclassification process when chains merge, tickers rename, or protocols pivot. Weightings shift through rebalancing after chain events such as halvings, burns, or large unlocks. You’ll always see the methodology tag near the ranking table, so the context is never hidden.

Crypto methodology in practice (simple flow):

Pull venue prices that pass liquidity checks → compute venue VWAP.

Apply VWAP and liquidity weighting across approved exchanges.

Multiply by circulating supply vs fully diluted to show both views.

Run anomaly and outlier handling and push updates to the table.

Mini‑example

| Token | Price | Circulating Supply | Fully Diluted Supply | Circulating Market Cap | Fully Diluted Market Cap |

|---|---|---|---|---|---|

| ABC | $2.00 | 100,000,000 | 150,000,000 | $200,000,000 | $300,000,000 |

Why this matters: Liquidity‑weighted pricing can keep thin exchanges from distorting ranks, and showing both caps clarifies lockups and emissions.

U.S. Stocks, ETFs & Indices Coverage

Equity data focuses on structure and continuity. Index tables list index constituents and sectors so you can see what drives each benchmark. Charts and tables account for corporate actions (splits, dividends) and flag symbol changes and mergers to keep history intact. ETF pages surface ETF holdings and expense ratios so you can validate what you really own. Sessions reflect NYSE/Nasdaq trading sessions with premarket/after‑hours display for context around gaps and drift.

Universe choices are documented with inclusion/exclusion rules, so micro‑caps, ADRs, or pink‑sheet names don’t sneak into the wrong screen. Time series incorporate dividend adjustments in charts to avoid false drawdowns around ex‑dates. Tape routing notes show tape A/B/C routing context, and turnover uses exchange‑reported volumes for a clean read on activity.

Corporate action impacts (quick guide)

| Event | What changes | Why you’ll notice |

|---|---|---|

| Split/Reverse split | Share count & price scale | Chart rescaled; screeners unaffected |

| Cash dividend | Total return series | dividend adjustments in charts maintain continuity |

| Merger/Ticker change | Identifier & history mapping | symbol changes and mergers note on profile |

| Index rebalance | index constituents and sectors | Weight shifts affect sector leadership |

Update Cadence, Accuracy & Quality Controls

Fast is good. Verified is better. Price streams target tick‑level feed timing where vendor rights allow, while fundamentals and ETF holdings land on measured schedules. Each print and row carries timestamp standardization so you can line up events, and modules that aren’t live carry clear delayed quote disclosure. If discrepancies arise, reconciliation with official prints resolves them through controlled revisions.

Data health is an ongoing process, not a one‑time setup. Engineers monitor checksum and data integrity at ingress and presentation layers. Production runs produce revision logs and audits that document any backfills or corrections. Thresholds for alerts follow internal error rate thresholds, and infrastructure includes vendor failover procedures to keep streams flowing. Market structure events trigger circuit breaker awareness logic, and service targets are published in simple SLA language for updates.

Quality pipeline (what happens to your data)

| Step | Control | Purpose |

|---|---|---|

| Ingest | timestamp standardization + checksum and data integrity | Align clocks, catch corruption |

| Validate | reconciliation with official prints | Correct stray ticks and late packets |

| Label | delayed quote disclosure | Set user expectations clearly |

| Monitor | error rate thresholds + vendor failover procedures | Auto‑escalate and switch streams |

| Review | revision logs and audits | Create a transparent paper trail |

Typical cadence by asset class

Equities/indices: stream quotes with tick‑level feed timing; fundamentals on filing or scheduled refresh.

ETFs: holdings as disclosed; revision logs and audits when constituents update.

Crypto: streaming where available; SLA language for updates clarifies expected refresh bands.

Limits & Interpretation Tips

No single metric tells the whole story. Rankings highlight size, not value, so always separate market cap vs intrinsic value when judging quality. Turnover is informative but imprecise, so remember the volume vs liquidity nuance around spreads, depth, and slippage. Historical leaderboards can hide losers, which is why survivorship bias warnings appear in long‑lookback lists. Patterns tempt us to over‑explain, so keep a correlation vs causation note handy and balance sentiment vs fundamentals balance when headlines get loud.

Use tables as a starting point, not a finish line. Learn how to read rankings responsibly by pairing them with context from macro and earnings on your calendar. Improve choices by avoiding single‑metric decisions and triangulating with multiple sources like filings, transcripts, and peer comps. Above all, keep portfolio risk framing front and center so ideas fit your horizon and drawdown tolerance.

Smart reading checklist

Pair market caps with profitability and cash flow (avoiding single‑metric decisions).

Cross‑check liquidity with spreads and depth (volume vs liquidity nuance).

Map catalysts to your calendar (context from macro and earnings).

Validate with a second dataset (triangulating with multiple sources).

Size positions to plan for bad days (portfolio risk framing).

Bottom line: The data on fintechzoom com is built to be useful and honest about its limits. You get transparent data sources and provenance, crisp update intervals by asset class, and plain‑spoken limitations and caveats. Use the methodology cues to judge reliability quickly, then apply the data interpretation guidance above to turn tables into better decisions.

How to Use FintechZoom (Playbooks for Stocks, Crypto & Research)

If you want to turn market noise into clear next steps, fintechzoom com makes that easier with step‑by‑step research workflows you can follow every day. Start with watchlist setup and tracking, then run screener recipes for U.S. markets to surface quality ideas. Add an alert configuration guide so key prices and events ping you on time. Finish with portfolio monitoring routines that keep you honest about risk and results. This is a task‑based walkthroughs approach that creates beginner to advanced pathways, complete with actionable checklists, a goal‑oriented research flow, and a repeatable weekly process you can actually stick to.

Five‑step daily playbook (10–15 minutes):

Open your dashboard and skim macro prints, sector breadth, and top movers.

Update watchlists; tag tickers by theme, catalyst, or risk level.

Run a screener and save one new idea with notes and links.

Set or adjust alerts on levels, events, or news phrases.

Review open positions and note one improvement for tomorrow.

Fast templates you can copy

Screener recipes for U.S. markets

| Goal | Filters (example) | Why it works |

|---|---|---|

| Dividend durability | Payout ratio < 60%, 5‑yr dividend CAGR > 7%, debt/EBITDA < 2.5 | Rewards quality and balance‑sheet strength |

| Momentum with risk guardrails | 50D > 200D, 14‑day RSI 45–65, Avg vol > 1M | Targets steady trends, avoids illiquidity |

| Value + cash returns | EV/EBIT ≤ sector median, FCF yield > 5% | Screens for profits at a fair price |

Alert configuration guide

| Event | Sample rule | Use case |

|---|---|---|

| Price | “Trigger at $X ± 0.25%” | Precision entries/exits |

| News | “Headline contains ‘guidance cut’ for tickers on list” | Fast reaction to catalysts |

| Economic | “30 mins before CPI / FOMC” | Prep time for risk alignment |

| Technical | “Break of 20‑day high/low” | Momentum confirmation |

Portfolio monitoring routines

Weekly: rebalance drift, recheck thesis notes, and refresh risk limits.

Monthly: compare sector weights vs benchmark and trim crowding.

Quarterly: audit winners and losers, archive learnings, and reset alerts.

Beginners: Learn Faster & Avoid Common Pitfalls

New to markets? Start simple and avoid errors that snowball. Use the glossary to get basic investing terms explained, then do your first watchlist setup with five names you understand. Try paper trading concepts to test ideas without real money. Build broad exposure with diversification 101, and read risk basics for new investors so position sizes fit your budget.

Begin with starting with small positions and scale only after wins are consistent. Keep avoiding FOMO trades by waiting for your signal checklist. Keep using education glossaries open in a side tab so new terms don’t derail you. Practice verifying sources before action by cross‑checking headlines with filings. And give yourself a buffer with budgeting and emergency fund rules, because peace of mind improves decisions.

Beginner action plan (first week):

Day 1–2: Read two 5‑minute explainers; annotate terms.

Day 3: Build a watchlist; add tags like “growth,” “dividend,” “turnaround.”

Day 4: Paper trade one idea using a tiny size and a stop.

Day 5: Journal what worked; update the checklist.

Active Traders: Find Setups & Manage Risk

Heat maps, movers, and scans let you spot momentum and breakout scans in seconds. Use intraday volatility tools to gauge ranges and avoid chop. Keep stop‑loss and position sizing rules pre‑written so you don’t improvise mid‑trade. During earnings, apply earnings‑week tactics like trade smaller and wait for the first 5–15 minutes to settle. For options exposure, lean on options‑adjacent signals (non‑execution)—open interest, skew, or IV rank—to time risk without placing derivatives trades here.

Edge comes from discipline. Write entry/exit rule discipline on your chart: trigger, confirmation, and invalidation. Size with average true range usage so stops reflect real volatility. Do event risk management by reducing size ahead of macro prints. Build premarket plan templates with scenarios A/B/C and invalidation levels. After the close, add post‑trade review notes to catch patterns you missed.

Template: single‑trade plan

| Field | Example |

|---|---|

| Trigger | Break above 20‑day high with volume > 150% |

| Stop | 1.2× ATR below entry |

| Target | 2–3× risk; partial at prior swing |

| Catalyst | Earnings next week; sector strength |

| Notes | Avoid midday entries; reassess on news spike |

Long‑Term Investors: Build & Monitor a Thesis

Long‑horizon returns come from business quality and patience. Start with fundamentals and cash flow trends to see how a company funds itself and shareholders. Track leadership with sector rotation tracking so you know when to add or underweight. Use dividend growth monitoring to favor rising payouts over “accidental high yield.” Anchor entries and trims with valuation bands over cycles rather than chasing peaks. Keep a quarterly review checklist to prevent thesis drift.

Write a one‑page thesis documentation template for every core holding. Maintain watchlist notes and catalysts like product launches or regulatory dates. Follow rebalancing frequency guidance—quarterly for most, semiannual for hands‑off. Keep tracking alpha vs benchmark to see if your idea is earning its keep. And set drawdown tolerance planning so you’re not forced out at the worst time.

Quarterly review checklist

Re‑read 10‑K/10‑Q highlights and update key metrics.

Compare margins, FCF, and leverage vs last year.

Re‑score moat, management, and capital allocation.

Re‑test valuation vs history and peers.

Document one reason to hold, add, or exit.

Crypto Investors: Combine Market Cap with News & On‑Chain Context

Digital assets move fast, so widen your lens. Start with dominance and liquidity screens to find where flows go. Build cap‑tier portfolio construction—for example, 60% large caps, 30% mid, 10% exploratory—to control risk. Watch exchange reserves signals and stablecoin flows overview to gauge pressure under the surface. Set rebalancing trigger levels so allocation drifts don’t pile on risk.

Blend charts with chain data. Use on‑chain metrics integration like active addresses or fees to confirm trends. Practice narrative vs data validation by checking claims against transactions and development activity. Add funding rate awareness to avoid buying tops during heated leverage. Apply altseason risk management by trimming into strength and rotating to quality when breadth weakens. Finally, protect assets with cold storage best practices such as hardware wallets and test withdrawals.

Simple cap‑tier framework (illustrative):

| Tier | Share | Rules |

|---|---|---|

| Large‑cap | 60% | Dominance > 2%, deep liquidity, multi‑venue pricing |

| Mid‑cap | 30% | Clear use case, improving metrics, listed on major venues |

| Explore | 10% | Strict position caps, event‑driven, exit on thesis break |

Bring it all together: Use the daily and weekly playbooks above to make step‑by‑step research workflows second nature. Keep watchlist setup and tracking tidy, save your favorite screener recipes for U.S. markets, and maintain an alert configuration guide that matches your style. Close the loop with portfolio monitoring routines so your goal‑oriented research flow becomes a repeatable weekly process. With fintechzoom com, the process becomes the edge.

FintechZoom vs Top Alternatives (When to Use Each)

Choosing the right toolkit starts with a clear research platform comparison rather than hype. fintechzoom com positions itself as a planning hub for news, data, and methodology, while rivals lean hard into charting, terminals, or execution. This section works as a buyer’s guide for market data tools so you can see strengths and trade‑offs in plain English. We’ll give you a high‑level pricing tiers overview without dollar promises, then map the best use cases by user type so you don’t overpay for power you’ll never use.

Use this simple decision framework for tools first. Look at the side‑by‑side feature matrix below, note where each platform excels, consider learning curve considerations, and read the total cost of ownership notes before you commit. This keeps your stack lean, fast, and fit for purpose.

Quick positioning (plain‑English view)

| Role | What it’s best at | You should use it when |

|---|---|---|

| fintechzoom com | Research context, methodology clarity, idea prep | You want a planning hub before placing trades |

| TradingView | Deep charting and community | You live on charts and scripts |

| Yahoo Finance | Snapshots and basic tracking | You need quick fundamentals and news |

| “Pro terminals” | Enterprise‑grade news + data depth | You need institutional coverage and speed |

Market‑Data Rivals (TradingView, Yahoo Finance, Bloomberg‑adjacent)

If you’re weighing charting‑heavy tools against research‑first hubs, start with a charting depth comparison and only then consider shiny extras. Platforms with strong communities offer community scripts and ideas, while research hubs lean into newswire integration breadth and context that speeds decisions. Compare portfolio tracking capabilities honestly; a lightweight tracker is fine if you already use a broker app. Finish with a cost vs feature analysis to avoid paying twice for the same function.

TradingView shines thanks to the TradingView indicators ecosystem and a vast library of user code. Yahoo is great for a Yahoo fundamentals snapshot and quick quotes. Enterprise platforms bring a pro‑grade terminals context with speed, breadth, and compliance features. Before you subscribe, verify API access availability and data export options so your workflow doesn’t hit a wall.

Market‑data tools — condensed side‑by‑side feature matrix

| Capability | fintechzoom com | TradingView | Yahoo Finance | Pro terminals |

|---|---|---|---|---|

| Charts | Solid for research | Very deep (indicators, layouts) | Basic | Elite |

| Community | Curated insights | Massive community scripts and ideas | Limited | N/A |

| News | Strong newswire integration breadth | Good | Good | Elite |

| Tracking | Focused portfolio tracking capabilities | Good | Good | Advanced |

| Integrations | Research‑first | API access availability varies | Limited | Broad |

| Output | Reports, notes, links | Strategy scripts, visuals | CSV | Full data export options |

| Cost tier | Free/freemium | Freemium/premium | Free/freemium | Premium/enterprise |

Tip: Decide whether you want a charting cockpit or a research cockpit. Mixing both often leads to feature overlap and higher costs.

Crypto‑Data Rivals (CoinMarketCap, CoinGecko, others)

Crypto research lives or dies by token listing coverage and clear methodology differences. Check exchange pair aggregation to avoid prices from thin markets skewing ranks. If you care about ecosystems, look for NFT and DeFi sections that don’t bury critical risk notes. Stress test sites for reliability during volatility because data integrity matters most on crazy days.

Method pages should state listing policy transparency and how they score venues. Some dashboards add liquidity score interpretation and show market cap vs FDV emphasis side by side so you understand unlock risk. Developer‑focused investors will want developer activity metrics, while cross‑chain users need cross‑chain asset tracking for bridges and wrapped tokens.

Crypto data focus — quick comparison

| Dimension | fintechzoom com | CoinMarketCap | CoinGecko |

|---|---|---|---|

| Coverage | Research‑layer context + rankings | Broad token listing coverage | Broad + community tools |

| Method | Transparent methodology differences | Detailed docs | Detailed docs |

| Pricing | Venue‑weighted reads | exchange pair aggregation | exchange pair aggregation |

| Extras | Deeper narratives | NFT and DeFi sections | NFT and DeFi sections |

| Stress | Emphasis on reliability during volatility | Good | Good |

| Metrics | Liquidity + context | market cap vs FDV emphasis | developer activity metrics friendly |

Use case: Planning a long‑only crypto basket? Start with large‑cap liquidity screens, confirm weights with FDV, then open narrative pages to validate or debunk hype.

Exchanges vs Data Platforms (Coinbase, eToro, Kraken, etc.)

Keep roles clean: order execution vs research tools serve different jobs. Exchanges handle custody and wallet services, orders, and settlements. Research hubs provide context, discovery, and education. Fees add up, so compare fee schedules and spreads carefully and expect KYC with KYC/AML onboarding steps on any brokerage or exchange. These platform role distinctions help you build a stack that’s stable and safe.

Ask where is the best place to place trades for your assets, then treat research hubs as research‑only environments. Your broker will handle account funding methods (ACH/wire), trade routing, and the trade ticket vs analysis page experience. Prioritize security and custody differences—separate research from accounts that hold assets to reduce operational risk.

Role map — research vs execution

| Need | Research platform | Exchange/Broker |

|---|---|---|

| Discovery & education | Yes | Not primary |

| Quotes & context | Yes | Basic |

| Orders & routing | Research only | Yes |

| Wallet/custody | custody and wallet services | |

| Costs | Research subs | fee schedules and spreads |

Decision Guide

This “if you need X, choose Y” table keeps choices practical and fast. It gives scenario‑based recommendations, supports budget‑driven selection, and separates beginner vs pro options. We also call out mobile vs desktop priority so you don’t buy a desktop‑first tool when you live on your phone.

If you need X → choose Y

| Need | Pick |

|---|---|

| Deep charts + scripts | TradingView |

| Fast fundamentals + news snapshot | Yahoo Finance |

| Research methodology + planning hub | fintechzoom com |

| Enterprise data + real‑time terminals | Pro terminals |

| Pure execution + custody | Your preferred exchange/broker |

Fast chooser — quick selection flowchart

Do you need to place trades here? If yes → broker/exchange. If no → research hub.

Is charting your main screen? If yes → charting platform. If no → research‑first platform.

Do you require APIs or exports? If yes → verify integrations before subscribing.

Tie‑breaker criteria

Data depth vs speed (where each platform excels).

Required features today vs later (must‑have vs nice‑to‑have list).

Team collaboration or solo workflow.

Audit/reporting needs and compliance.

Total cost of ownership notes

Subscriptions + data add‑ons + storage + time to learn = real cost.

Avoid duplicate features across apps.

Annual billing discounts help only if you’re sure you’ll stay.

Migration considerations

Can you move watchlists, notes, and layouts easily?

Do exports/imports preserve tags and alerts?

Is there rollback if the new stack underperforms?

Trial period suggestions

Use free tiers to recreate your daily routine for a week.

Stress‑test on an earnings day or macro event.

Cancel ruthlessly if it adds steps without new signal.

Bottom line: choose tools by workflow, not brand. Pair fintechzoom com with a broker for execution, add charting only if you truly need it, and let this research platform comparison guide a stack that fits your goals and time. This is a practical buyer’s guide for market data tools that highlights strengths and trade‑offs, offers a realistic pricing tiers overview, and maps the best use cases by user type—so your choices pay for themselves.

Trust, Security & U.S. Regulatory Context

Trust is earned with clarity, not fine print. On fintechzoom com, the goal is to protect readers while explaining how decisions are made. That starts with clear data privacy practices and modern security standards and encryption across pages that touch your account or preferences. U.S. readers should always see compliance disclosures USA, along with plain‑English conflicts of interest statements and visible YMYL content safeguards on money‑related pages. You’ll also find transparent editorial policies, advertiser relationship clarity, and simple user consent management for cookies and tracking, plus disclosures on third‑party data handling and a high‑level security posture overview.

Why this matters to you (quick view)

| Safeguard | What to look for | Why it helps |

|---|---|---|

| data privacy practices | What is collected, how long it’s kept | Reduces surprise and oversharing |

| security standards and encryption | HTTPS, modern ciphers, TLS everywhere | Protects logins and preferences |

| compliance disclosures USA | Who provides data, licensing notes | Sets correct expectations |

| conflicts of interest statements | Ad/affiliate disclosures | Lets you weigh recommendations |

| YMYL content safeguards | Fact‑checking and expert review | Higher bar for accuracy on finance topics |

| user consent management | Clear accept/opt‑out choices | Respects your choices and local laws |

| security posture overview | Summary of defenses and monitoring | Confidence during volatile news cycles |

Data Privacy & Account Security

Privacy is a design choice, not a checkbox. Expect a page‑level summary of privacy policy summaries and a permissions model based on a least‑privilege access model so only the right systems see your data. Login flows should offer two‑factor authentication (2FA), while storage and transport use encryption at rest and in transit. You can adjust cookie preferences and opt‑outs easily, and if something goes wrong, a documented breach notification process explains how you’ll be informed and protected. Day to day, smart defaults like session timeout settings, device recognition alerts, password hygiene guidance, and practical phishing prevention tips cut the most common risks.

Account security checklist (copy‑ready)

Turn on two‑factor authentication (2FA) for sign‑ins and critical actions.

Confirm encryption at rest and in transit on the account and settings pages.

Set cookie preferences and opt‑outs to your comfort level.

Verify session timeout settings and enable device recognition alerts.

Read privacy policy summaries; understand third‑party data handling of analytics or ads.

Follow password hygiene guidance and review phishing prevention tips quarterly.

Know the breach notification process before you need it.

U.S. Compliance Basics (SEC/FINRA/CFTC Disclaimers)

Finance is regulated for a reason. A research site should lead with a not investment advice disclaimer and maintain strict research vs solicitation clarity so you never confuse analysis with a call to trade. If a broker or publisher is involved, you’ll see Reg BI awareness for brokers, market data licensing notes, and relevant communications rule references. Good pages provide a brief SEC and FINRA guidelines overview and highlight CFTC jurisdiction for derivatives where futures or leveraged tokens are discussed. Advertising is handled with clear advertising disclosure language, obvious affiliate link transparency, and consistent risk disclosure best practices on strategy content.

Compliance snapshot (what belongs where)

| Topic | Research website should… | Broker/exchange must… |

|---|---|---|

| Advice vs info | Display not investment advice disclaimer | Suitability and Reg BI awareness for brokers |

| Data rights | Show market data licensing notes | Maintain licensing and fee transparency |

| Communications | Cite communications rule references | Keep required archives and supervision |

| Ads/Affiliates | Use advertising disclosure language and affiliate link transparency | Disclose promotions per FINRA rules |

| Risks | Apply risk disclosure best practices on all strategies | Provide product‑specific risk docs |

Example disclosure block (plain English):

This content is for education only and is not a recommendation to buy or sell any security. Data may be delayed or limited by licensing. We may earn from some links; see our ad and affiliate disclosures for details.

Editorial Independence & Review Methodology

Credible reviews start with process. Tool roundups specify scoring rubrics for products and publish hands‑on testing criteria so readers know what was measured. If revenue is involved, affiliate revenue separation keeps business deals away from scores. Updates are tracked in a public correction and update policy, and writers meet reviewer qualification standards that match the topic. Behind the scenes, a conflict‑mitigation framework guides assignments, while findings must show evidence‑backed conclusions that anyone can replicate through a reproducible review process with clear sourcing and citation norms. Finally, a periodic re‑evaluation cadence keeps picks fresh as markets and products evolve.

How a fair review gets built (step‑by‑step)

Define the scoring rubrics for products and weightings before testing.

Run hands‑on testing criteria in identical scenarios; capture logs and screenshots.

Enforce affiliate revenue separation during scoring; lock scores before any ad talks.

Draft with sourcing and citation norms; attach datasets or methods.

Publish with a visible correction and update policy and set a periodic re‑evaluation cadence.

Bottom line: A trustworthy finance site earns attention with structure, not slogans. Look for transparent editorial policies, explicit compliance disclosures USA, and modern security standards and encryption backed by an open security posture overview. When conflicts of interest statements are prominent and YMYL content safeguards are active, you can focus on research—because fintechzoom com has already done the hard work in the background.

Market Trends & Insights You’ll Find on FintechZoom

Markets move in patterns, not straight lines. On fintechzoom com, you’ll find clear context around macro themes shaping markets and how they trickle into sectors, styles, and risk. Dashboards track sector leadership changes as money rotates between growth, value, and defensives. Curated charts explain liquidity and rate dynamics, connect them to earnings season highlights, and pair them with digital asset adoption trends so stocks and crypto tell a consistent story. Each section includes plain‑English interpretation of economic prints, calls out cross‑asset correlations, and flags retail vs institutional flows that often precede regime shift signaling and other forward‑looking indicators you can act on.

Signals you’ll actually use

| Insight | Where you’ll see it | Why it matters |

|---|---|---|

| macro themes shaping markets | Fed/Rates, Inflation, Growth | Sets the tone for risk and multiples |

| sector leadership changes | Heatmaps & factor screens | Rotations point to next winners/losers |

| liquidity and rate dynamics | Yield curves, credit spreads | Liquidity drives risk appetite |

| earnings season highlights | Calendar + revisions boards | Guidance shifts move markets fast |

| digital asset adoption trends | Crypto overview pages | Tech sentiment often bleeds into equities |

| interpretation of economic prints | CPI, PPI, jobs explainers | Turns headlines into decisions |

| cross‑asset correlations | Equities, bonds, crypto, USD | Confirms or challenges your thesis |

| retail vs institutional flows | ETF/mutual fund estimates | Helps time entries and trims |

| regime shift signaling | Volatility, breadth, trend | Warns when playbooks must change |

| forward‑looking indicators | PMIs, housing, freight | Early hints before earnings catch up |

2020–2025 Crypto Market Cap Themes (What Mattered)

Crypto’s last half‑decade was shaped by cycles and plumbing. You’ll see halving cycle effects tied to supply math, plus Layer‑2 scaling momentum that lowered fees and improved speed. Stablecoins became the grease for liquidity, so stablecoin supply shifts are front‑and‑center on dashboards. Sentiment whipsawed with the regulatory headlines impact, while institutions tested the waters and drove institutional spot demand at key moments. Method pages summarize ETF approval narratives, visualize on‑chain activity waves, and annotate liquidity rotation phases so you can separate noise from signal, even during security incidents and forks. Builder metrics highlight developer ecosystem growth, which often leads price by months.

Crypto context you can scan in one minute

| Theme | What to check | Actionable read |

|---|---|---|

| halving cycle effects | Supply emission charts | Expect narrative spikes near events |

| Layer‑2 scaling momentum | TPS/fee dashboards | Lower friction can widen participation |

| stablecoin supply shifts | Net issuance & dominance | Expanding float = easier risk‑on |

| regulatory headlines impact | Timeline + jurisdiction tags | Policy clarity reduces risk premium |

| institutional spot demand | Large inflow trackers | Flows can anchor floors on dips |

| ETF approval narratives | Filing timelines & assets | Adds new buyers and credibility |

| on‑chain activity waves | Active addresses, fees | Confirms real usage vs hype |

| liquidity rotation phases | Large → mid → long tail maps | Time re‑entries, avoid late chases |

| security incidents and forks | Incident log + fixes | Manage idiosyncratic risk per asset |

| developer ecosystem growth | Repo commits, grants | Early signal for durable trends |

Mini‑example: If stablecoin supply shifts higher while on‑chain activity waves rise and liquidity rotation phases move from large caps to mids, conviction for a broader alt move increases—until a new regulatory headlines impact resets the probabilities.

Key Drivers for U.S. Stocks

Stock narratives change, but the scaffolding is stable. Watch the interest rate path and yields, then layer CPI/PPI and inflation trends to set expectations for margins and multiples. Track earnings revisions breadth to see whether guidance is rising or slipping under the surface. Weekly dashboards show consumer spending signals and a sector rotation playbook so you’re never guessing which groups are in charge. Context comes from Fed policy communications, labor market prints (NFP), and signs of credit conditions tightening, which roll into margin dynamics by industry and small‑cap vs mega‑cap dispersion when risk appetite changes.

U.S. equity driver map

| Driver | What to watch | Why it moves prices |

|---|---|---|

| interest rate path and yields | Curve shape, real yields | Valuation math and discount rates |

| CPI/PPI and inflation trends | Core metrics, rent, wages | Input costs and Fed reaction function |

| earnings revisions breadth | Up vs down ratio by sector | Future returns track revisions |

| consumer spending signals | Cards, retail sales, confidence | Top‑line sensitivity and mix shift |

| sector rotation playbook | Leadership, breadth, factor tilt | Aligns positions with the tape |

| Fed policy communications | Statements, dots, speeches | Sets the macro regime |

| labor market prints (NFP) | Jobs, wages, participation | Growth vs overheating balance |

| credit conditions tightening | Lending surveys, spreads | Growth throttle and default risk |

| margin dynamics by industry | Input costs, pricing power | Determines EPS resilience |

| small‑cap vs mega‑cap dispersion | Relative strength ratio | Risk sentiment and liquidity test |

Case snapshot: Revisions turn negative while credit conditions tightening rises and defensives take the lead in the sector rotation playbook. Pair down cyclicals, increase cash, and watch Fed policy communications for the pivot.

What to Watch Next (Near‑Term Outlook)

Short horizons need structure, not guesses. Start with an upcoming earnings calendar and add a FOMC and CPI watchlist to prepare for macro swings. Seasonality can matter, so track seasonality and quarter‑end flows around fund rebalancing. Options can amplify moves, so note options expiration effects near monthly and quarterly dates. Finally, mark key support/resistance zones on your watchlist so you react at levels, not emotions.

Turn the plan into clicks with a catalyst calendar setup and thoughtful alert thresholds planning. Visualize risk using a risk event heatmap, then commit to a post‑event play review so your process compounds over time. When outcomes are uncertain, sketch probability‑weighted scenarios and size positions accordingly.

Near‑term checklist (ready to paste into your planner)

Add upcoming earnings calendar names you own or follow.

Build a FOMC and CPI watchlist and write your “if‑then” notes.

Tag seasonality and quarter‑end flows dates for rebalancing noise.

Note options expiration effects that can boost gamma moves.

Draw key support/resistance zones and link alerts.

Finish catalyst calendar setup and test alert thresholds planning.

Review risk event heatmap the night before.

Do a 5‑minute post‑event play review to capture lessons.

Revisit probability‑weighted scenarios after big surprises.

Bottom line: Use fintechzoom com to turn signals into steps. Read the big picture through macro themes shaping markets, confirm moves with cross‑asset correlations, and prepare with calendars and alerts that highlight forward‑looking indicators. Whether you follow crypto’s liquidity rotation phases or equities’ earnings revisions breadth, the right context turns noise into decisions you can defend.

Real‑World Case Studies & Practical Examples

Here’s where research turns into action. On fintechzoom com, you’ll find step‑by‑step walkthroughs that show every click and choice, plus actionable research examples you can copy in minutes. Each playbook uses template‑driven analysis so you don’t start from scratch, and it’s packaged as a repeatable strategies blueprint you can run weekly. Most important, we track outcomes with measurable outcome tracking so you know what helped and what to refine.

Every case below includes before/after portfolios, with parameter choices explained in plain English. We add sensitivity checks and guardrails to keep risk in line, then finish with a short lessons learned recap to lock in progress. Over time, this becomes evidence‑based iteration—you improve because you measure.

Case index (what you’ll get at a glance)

| Playbook | Goal | What you copy |

|---|---|---|

| Crypto rebalancing by market‑cap tiers | Reduce volatility while staying invested | Allocation table, drift rules, alert list |

| Dividend growth screener | Lift dividend quality and stability | Filter set, watchlist tags, review cadence |

| Event‑week volatility plan | Trade less emotionally around big prints | Pre‑event checklist, position rules, debrief form |

Rebalancing a Crypto Portfolio by Market‑Cap Tiers

Start with a simple allocation that respects large‑cap vs mid‑cap weighting and avoids concentration. Define threshold‑based rebalances to correct drift before it gets dangerous. Assign a clear risk budget allocation so you never guess sizing on a busy day. Keep 5–15% in cash via stablecoin buffer usage for flexibility, and perform exchange liquidity checks so thin books don’t erase gains at the exit.

First, write your tier definitions and cutoffs (example below), then turn on drift monitoring alerts that ping when any tier moves ±5% from target. Stay mindful of slippage and fees awareness, especially on small caps, and plan custody and transfer timing so you’re not moving funds during peak spreads. If you realize gains in the U.S., document tax‑lot selection considerations (USA)—FIFO vs specific ID—before you rebalance.

Tier template (copy‑ready)

| Tier | Target Weight | Rule | Notes |

|---|---|---|---|

| Large‑cap | 60% | Top assets by market cap & liquidity | Lower slippage, high venue coverage |

| Mid‑cap | 25% | Next liquid cohort | Higher upside, tighter position caps |

| Explore | 10% | Small, event‑driven names | Hard stop on losses, time‑boxed holds |

| Stablecoin buffer usage | 5% | Cash for buys, volatility shock absorber | Refill during strength |

Rebalance triggers

threshold‑based rebalances at ±5% per tier.

drift monitoring alerts for each tier and for total crypto weight.

Pre‑trade checklist: exchange liquidity checks, slippage and fees awareness, custody and transfer timing window.

Before/after portfolios (illustrative, not advice)

| Metric | Before | After |

|---|---|---|

| Max drawdown | ‑48% | ‑36% |

| 30‑day volatility | 22% | 16% |

| Rebalance count/quarter | 0 | 2–3 |

| Notes | No buffer, inconsistent sizing | Clear tiers, buffer, alerts active |

Lessons learned recap: Clear tiers and a small buffer reduce pain without muting upside. Document rules once, then let alerts do the nagging.

Finding Dividend Growth Stocks with Screeners

Quality income starts with rules, not yield alone. Begin with dividend streak requirements (e.g., 5–10 years of raises) and add payout ratio filters to avoid fragile payers. Confirm durability with free cash flow coverage and smoothness via earnings stability metrics. Finally, plan ex‑dividend date tracking so you don’t confuse price gaps with real losses.

Add guardrails with dividend safety indicators such as interest coverage and leverage ceilings. Keep sector diversification rules so one theme doesn’t dominate checks and balances. Note reinvestment (DRIP) notes if you auto‑reinvest, and track yield on cost perspective over time instead of chasing today’s sticker yield. For U.S. tax season, capture 1099‑DIV implications (U.S.) early so there are no surprises.

Dividend growth screener (starter set)

| Filter | Example Setting | Why it matters |

|---|---|---|

| dividend streak requirements | ≥ 5 years of consecutive increases | Signals discipline and resilience |

| payout ratio filters | < 60% of earnings | Room to fund growth + dividends |

| free cash flow coverage | FCF ≥ dividends for 3 of 4 years | Cash backs up promises |

| earnings stability metrics | EPS std‑dev below sector median | Smooth operations, less drama |

| Valuation | Forward P/E ≤ sector median | Avoids overpaying for safety |

| Balance sheet | Net debt/EBITDA < 2.5x | Shock resistance |

| ex‑dividend date tracking | Calendar + alerts | Avoid accidental yield chasing |

Before/after portfolios (illustrative)

| Metric | Before | After |

|---|---|---|

| Avg dividend growth (5‑yr) | 4.1% | 8.3% |

| Dividend cuts (12 mo) | 2 | 0 |

| Sector concentration | 58% Utilities | 28% Utilities (balanced per sector diversification rules) |

Lessons learned recap: Strong payers show up when you prioritize cash coverage and stability. Track results quarterly, reinvest thoughtfully (reinvestment (DRIP) notes), and record wins/losses for the next screen run.

A Volatility Playbook for Event Weeks

Big macro or earnings weeks reward process. Start with implied vs realized vol checks to decide if options markets are pricing a storm or a sprinkle. Use ATR‑based position sizing so your stop isn’t a coin flip. Sketch event risk hedging ideas—smaller size, pairs, or defined‑risk structures on your broker—then finalize gap risk management for overnight trades. Keep a newsflow triage protocol so signal beats noise at the open.

Write your pre‑event scenario planning with bull/base/bear paths and invalidation levels. Codify stop placement frameworks so losses are mechanical, not emotional. Learn IV crush awareness if you use options, and publish position scaling rules ahead of time so you don’t add into chaos. After the dust settles, complete a post‑event debrief template to cement lessons.

Event‑week checklist (education only)

| Step | What to do | Outcome |

|---|---|---|

| Vol read | implied vs realized vol checks + breadth | Regime context |

| Size | ATR‑based position sizing | Stops sized to reality |

| Hedge | event risk hedging ideas | Pre‑planned defense |

| Overnight | gap risk management rules | Smaller gap surprises |

| Info flow | newsflow triage protocol | Prioritize catalysts |

| Plan | pre‑event scenario planning | Clear decision tree |

| Risk | stop placement frameworks | Fewer ad‑hoc exits |

| Options | IV crush awareness | No “why did premium vanish?” |

| Scale | position scaling rules | Controlled adds/cuts |

| Review | post‑event debrief template | Playbook improves next time |

Before/after (illustrative)

| Metric | Before | After |

|---|---|---|

| Avg loss on stop | ‑1.9R | ‑1.2R |

| “News chase” trades | 7 | 2 |

| Plan adherence | 52% | 88% |

Lessons learned recap: Event weeks are won the night before. Plans beat reflexes, and small, well‑sized trades beat big, hopeful ones.

Bring it together: Use fintechzoom com to copy the structures above and adapt them to your watchlist. Keep your parameter choices explained in a notes doc, run sensitivity checks and guardrails monthly, and build a habit of measurable outcome tracking with quick before/after portfolios snapshots. The more you review, the faster your evidence‑based iteration compounds. Educational content only—this is not investment advice.

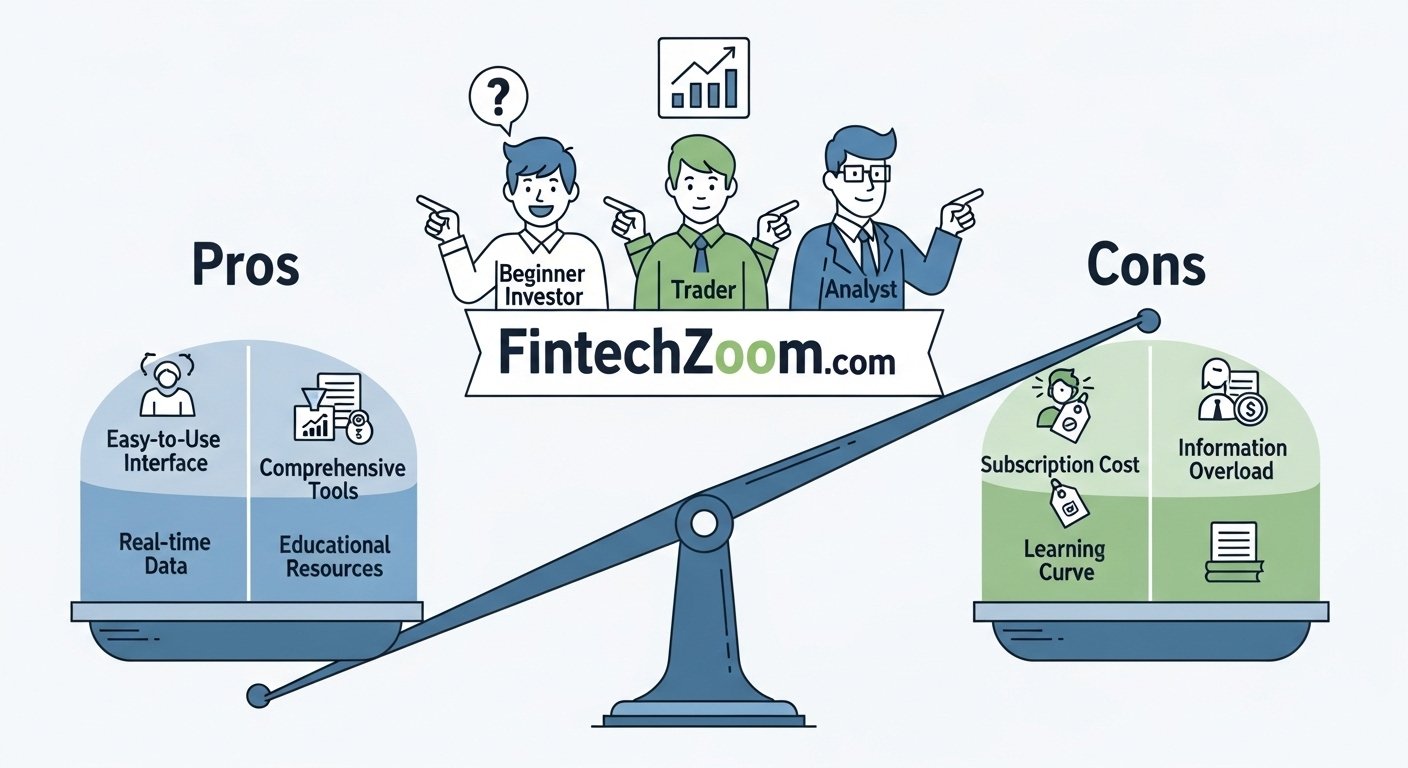

Pros, Cons & Who FintechZoom Is Best For

Choosing tools is easier when you see a strengths and limitations recap in one place. fintechzoom com is a research‑first hub that shines at context, education, and planning. Below you’ll find an ideal user profiles map, a plain‑English value for money assessment, and a concise feature coverage summary. We’ll also touch on the learning curve overview, list best‑fit criteria, and share decision confidence boosters with alternative pairing suggestions and upgrade path guidance so you can build a stack that fits your day.

Quick snapshot: Pros vs Cons

| Category | What you’ll notice | Why it matters |

|---|---|---|

| Pros | breadth of asset coverage, timely market updates, intuitive research tools, educational depth, alerting effectiveness | Faster discovery, less guesswork |

| Cons | missing execution features, advanced analytics gaps, data licensing constraints, limited customization areas, mobile vs desktop tradeoffs | You may add a second app for charts or trading |

What FintechZoom Does Well

If you want to research faster, fintechzoom com delivers usability highlights out of the box. The breadth of asset coverage helps you move from stocks to crypto without changing tabs. You’ll see timely market updates side‑by‑side with narrative notes for clarity of insights you can act on. Clean menus and summaries make the intuitive research tools feel natural, which leads to real workflow acceleration during busy sessions.

The platform supports learners and pros. Guides, glossaries, and examples add educational depth so new readers level up quickly. Alerts, calendars, and event cards offer alerting effectiveness without spam. During high‑volume days, layouts keep their shape, which improves reliability under stress and preserves analyst‑grade context when you need it most.

Feature coverage summary (at a glance)

Multi‑asset dashboards with breadth of asset coverage.

News + charts combo for timely market updates and clarity of insights.

Screeners and notes for intuitive research tools and workflow acceleration.

Guides, primers, and checklists for educational depth.

Flexible alert types for alerting effectiveness during catalysts.

Limitations to Know

No single site can do everything. Because this is research‑first, you’ll find missing execution features like order tickets and account funding. Power chartists may notice advanced analytics gaps compared with specialized platforms. Some feeds carry data licensing constraints, which can affect depth or refresh rates. A few modules have limited customization areas, and you may feel mobile vs desktop tradeoffs if you work from a phone all day.

To make smart choices, look for transparency on caveats in docs and release notes. Read planned roadmap mentions to see what’s coming. You can cover gaps with workarounds and integrations that connect watchlists, notes, or exports to other apps. Expect a small expected learning investment in week one. If you need niche features, consider third‑party tool pairing instead of forcing a single app to do it all.

Common gaps → practical fixes

| Gap | What it means | Fix |

|---|---|---|

| missing execution features | Research only, no trading | Pair with your broker/exchange |

| advanced analytics gaps | Limited pro‑level chart studies | Add a dedicated charting suite |

| data licensing constraints | Some quotes/fields limited | Confirm coverage; use secondary sources |

| limited customization areas | Fewer layout tweaks | Save views, export key tables |

| mobile vs desktop tradeoffs | Desktop is smoother | Use mobile for alerts; analyze on desktop |

Best‑Fit Users (And Who Should Consider Alternatives)

The sweet spot is clear. fintechzoom com is ideal for research‑first investors who want to plan first and trade elsewhere. It’s great for education‑focused beginners who benefit from guardrails and explainers. If you prefer to keep research separate from accounts, the non‑custodial preference makes sense. It also serves budget‑conscious users who want strong context without enterprise pricing, and pro traders needing supplements who require fast prep before the open.

If you live inside a terminal all day, note when a terminal is required for depth or speed. Specialists should consider the heavy options users caveat and bring a dedicated options platform for modeling. Quants and builders may prioritize automation/API needs and use APIs elsewhere while keeping this for dashboards. Coverage is wide, but some areas may have niche asset coverage gaps; confirm before committing. Finally, check your institutional vs retail fit—a lean research hub can pair well with pro tools rather than replace them.

Who it’s for (best‑fit criteria)

| Profile | Fit | Why |

|---|---|---|

| research‑first investors | ✅ | Planning hub with strong context |

| education‑focused beginners | ✅ | Guides and checklists reduce mistakes |

| budget‑conscious users | ✅ | Solid value without terminal costs |

| pro traders needing supplements | ✅ | Fast prep before execution elsewhere |

| Execution‑only traders | ⚠️ | Use broker; keep this for research |

| Options power users | ⚠️ | Bring a modeling/greeks platform |

| Enterprise desks | ⚠️ | Mix with a terminal when a terminal is required |

Value, Learning, and Next Steps

A realistic value for money assessment weighs time saved against subscriptions you already pay for. If it replaces two or three scattered tabs, the value is clear. The learning curve overview is mild; most users are productive within a week if they follow the quick‑start. For stack design, start with these alternative pairing suggestions: research hub + broker for execution; add a charting app only if your work demands it. If your needs grow, use the upgrade path guidance: step up to advanced charting, then to a terminal if and when deeper data is mission‑critical.

Decision confidence boosters

Write your best‑fit criteria before trials.

Time how long common tasks take now vs after.

Confirm coverage on your tickers and asset classes.

Pilot with one watchlist and one screener for a week.

Keep an exit plan if the tool adds steps instead of removing them.

Bottom line: Use fintechzoom com for planning and perspective, accept where it falls short, and pair it wisely. With clear expectations and the right complements, you’ll get a lean stack that frees you to focus on ideas—not interfaces.

Conclusion

In a crowded market of finance tools, fintechzoom com stands out as a research‑first hub that helps you move from noise to decisions. You get live market coverage with context, clear methodology, and U.S.‑focused insights that make earnings weeks and macro days easier. Powerful technical and fundamental screeners surface quality ideas without guesswork, while market alerts and watchlists keep you ready when catalysts hit. Trust matters, so the platform leans on transparent data privacy practices and plain‑English disclosures.

Our research platform comparison also showed where it shines and where pairing it with a broker or a charting suite makes sense. If you’re new, start with the playbooks and FAQs. If you’re advanced, plug in screeners, set alert rules, and journal results. Either way, take one small step today—build a watchlist, run a screener, or schedule a five‑minute review. The right routine compounds. Use this guide as your blueprint and let your process—not the headlines—drive your next move.

Explore More Topic: Crypto30x.com

Frequently Asked Questions

What services does FintechZoom.com provide?

FintechZoom.com offers a research‑first toolkit for investors. You get news, data, and research features, unbiased platform reviews, and dashboards for U.S. markets and crypto. Set alerts with market alerts and screeners, save watchlists, and learn from tutorials and glossaries. A clear scope of services list explains premium vs free access and the content update schedule. It’s built for investors who want coverage across stocks and crypto in one place.

Is FintechZoom good for beginners?

Yes—FintechZoom.com is friendly for new investors. Short explainers, beginner tutorials and guides, and simple screening presets help you take first steps fast. A glossary and definitions page reduces jargon, while risk basics for newcomers are woven into articles. Expect suitability for novices with realistic setup time expectations and hand‑holding resources. Community and support options guide you away from common pitfalls.

How accurate and up‑to‑date is the crypto market cap data?

Crypto rankings on fintechzoom com are built for clarity. You’ll see refresh interval specifics, approved venues, and exchange coverage scope so pricing makes sense. Method notes link to methodology documentation, including a data validation pipeline, timestamp and source labeling, and delayed vs real‑time flags. Quality assurance checkpoints handle anomalies, while rounding and precision notes explain small differences across feeds.

Can I get stock market updates and trading ideas from FintechZoom?

Yes. FintechZoom.com posts intraday U.S. market updates, curated headlines, and charts, plus earnings and economic calendars you can follow in ET. You’ll also find sector and theme roundups and learning‑oriented insights. Any ideas are non‑advisory commentary, but you can set alert setup for watchlists and track event‑driven coverage. Content cadence expectations are clear so you know when to check back.

Does FintechZoom cover cryptocurrencies beyond market cap rankings?

Beyond rankings, FintechZoom.com covers narratives and risk. Expect news and narrative tracking, on‑chain data context, and token research deep dives with methodology for token inclusion. Pages blend qualitative + quantitative analysis and flag low‑liquidity risks. Coverage breadth by sector highlights DeFi, L2s, and infrastructure. Update policies for listings explain when new assets are added or reclassified.