The Ashcroft Capital lawsuit has become a major talking point in the real estate investment world, sparking debates about accountability, transparency, and investor protection. For many investors, the case has raised red flags around issues such as paused distributions, unexpected capital calls, and liquidity worries that directly affect cash flow. These concerns have created uncertainty not just for limited partners involved in the lawsuit but also for the wider real estate syndication market, where investor confidence is key.

At the same time, the case highlights bigger industry challenges, including questions about industry credibility, ethical standards among sponsors, and the long-term health of syndication models. By exploring investor reactions, lawsuit developments, and possible outcomes, this article provides clear insights into what’s happening and why it matters. Most importantly, it will also outline practical steps investors can take to safeguard their capital and prepare for future risks in real estate investing.

What is the Ashcroft Capital Lawsuit?

The Ashcroft Capital lawsuit has become one of the most talked-about cases in the real estate syndication market in the U.S.. To understand it better, let’s start with some context. Ashcroft Capital is a well-known real estate syndication firm that specializes in multifamily investment group deals and private equity real estate funds. The company has attracted thousands of investors by pooling capital into private placement deals and acquiring large apartment communities across the country.

But in recent years, growing frustration from limited partners has led to disputes, sparking what many describe as one of the most significant investment firm litigation cases in the sector. At its core, the case revolves around investor protection concerns and whether the firm’s promises aligned with reality. These tensions have evolved into full-blown investor lawsuits in real estate, raising questions about oversight and transparency in alternative investments.

The background of the legal case shows that investors were drawn in by strong marketing claims and attractive financial projections. However, allegations soon surfaced about origins of the dispute, pointing to issues like missed return targets, lack of timely communication, and potential compliance gaps. In simpler terms, many investors felt they were not given the full picture, and this has opened the door to regulatory scrutiny of investment firms.

For example, in private equity real estate, numbers matter just as much as trust. If an investment sponsor claims an internal rate of return (IRR) of 15% but delivers half of that, investors begin to question not only the math but also the sponsor’s credibility. This case highlights why investors filed legal action—to seek clarity, accountability, and possibly compensation.

The company profile and history of Ashcroft Capital also plays into the case. Having managed billions in assets and marketed itself as a trusted partner in multifamily housing, the lawsuit has shaken confidence in the model. While the firm continues operations, the lawsuit has cast a shadow over its future fundraising and relationships with investors.

Key Allegations Against Ashcroft Capital

The Ashcroft Capital lawsuit is built around several major allegations. Each one highlights different ways investors believe they were misled or underserved. Below, we break down the five key claims and their impact on trust in the real estate syndication firm.

Misrepresentation of Returns (IRR Projections)

One of the strongest allegations is misrepresentation of projected returns. Investors claim that Ashcroft Capital presented inflated IRR claims that painted a picture of much higher profits than what was actually achievable. In simple terms, it’s like being promised a first-class ticket but ending up with economy seating.

This projected returns dispute matters because many investors use IRR as the main yardstick for performance. If the sponsor shows an IRR of 16–18% but the actual returns fall to 7–8%, it creates a huge gap between investor expectations vs actual returns. Such internal rate of return discrepancies raise questions about performance data accuracy and whether these numbers were realistic in the first place.

For U.S. investors who rely on syndications, this is not just about numbers—it’s about trust. Overpromising and underdelivering creates a risk vs reward misalignment that damages long-term confidence in the firm.

Lack of Full Financial Disclosures

Another major allegation revolves around incomplete financial reports. Investors argue that they were not given access to full details, including missing audit records and undisclosed expenses. This lack of clarity has been described as opaque accounting that makes it difficult for limited partners to fully assess performance.

In private offerings, disclosure obligations are critical. Investors depend on these documents to perform due diligence and understand risks. When financial reporting doesn’t meet transparency requirements, it leaves room for suspicion and possible SEC compliance issues.

Think of it like buying a car without seeing the full service history—you might get the vehicle, but you’ll never know if there are hidden problems under the hood.

Investor Communication Concerns

The lawsuit also claims that Ashcroft Capital failed to maintain effective communication with its limited partners. Complaints include delayed investor updates, inconsistent reporting, and a general lack of investor relations. For many, this poor transparency led to a breakdown in trust.

In real estate syndications, regular updates on property performance, cash flow, and distributions are standard practice. When investors don’t hear back on time, it raises doubts about whether management is hiding something. Unanswered LP questions became a red flag, showing how timely reporting practices are not just a courtesy—they’re a requirement for maintaining confidence.

Sponsor Fees and Performance Disputes

A hotly debated issue involves high management fees and other hidden charges. Limited partners argue that fees were collected even when performance lagged, creating GP vs LP fee conflicts. This has been framed as a misalignment between sponsor compensation concerns and investor outcomes.

In investment partnerships, performance-based compensation is supposed to encourage better results. But if sponsors earn hefty fees regardless of how deals perform, it creates tension. Investors claim this imbalance weakened accountability and hurt their returns. Essentially, the sponsors got paid even when the properties didn’t perform as promised.

Potential Securities Law Issues

Finally, there are allegations tied to possible securities fraud claims. Investors suggest that some offerings may have crossed into unregistered offerings or compliance violations. This has drawn the attention of regulators, as such issues fall under federal securities law.

The lawsuit hints at SEC involvement and the risk of regulatory enforcement if violations are confirmed. These concerns tie into broader investor protection laws, which are designed to prevent misleading marketing or improper fundraising practices.

If true, these possible violations wouldn’t just affect Ashcroft Capital. They could set investor lawsuit precedents that reshape how private equity real estate funds are structured in the U.S.

Timeline of Lawsuit Developments

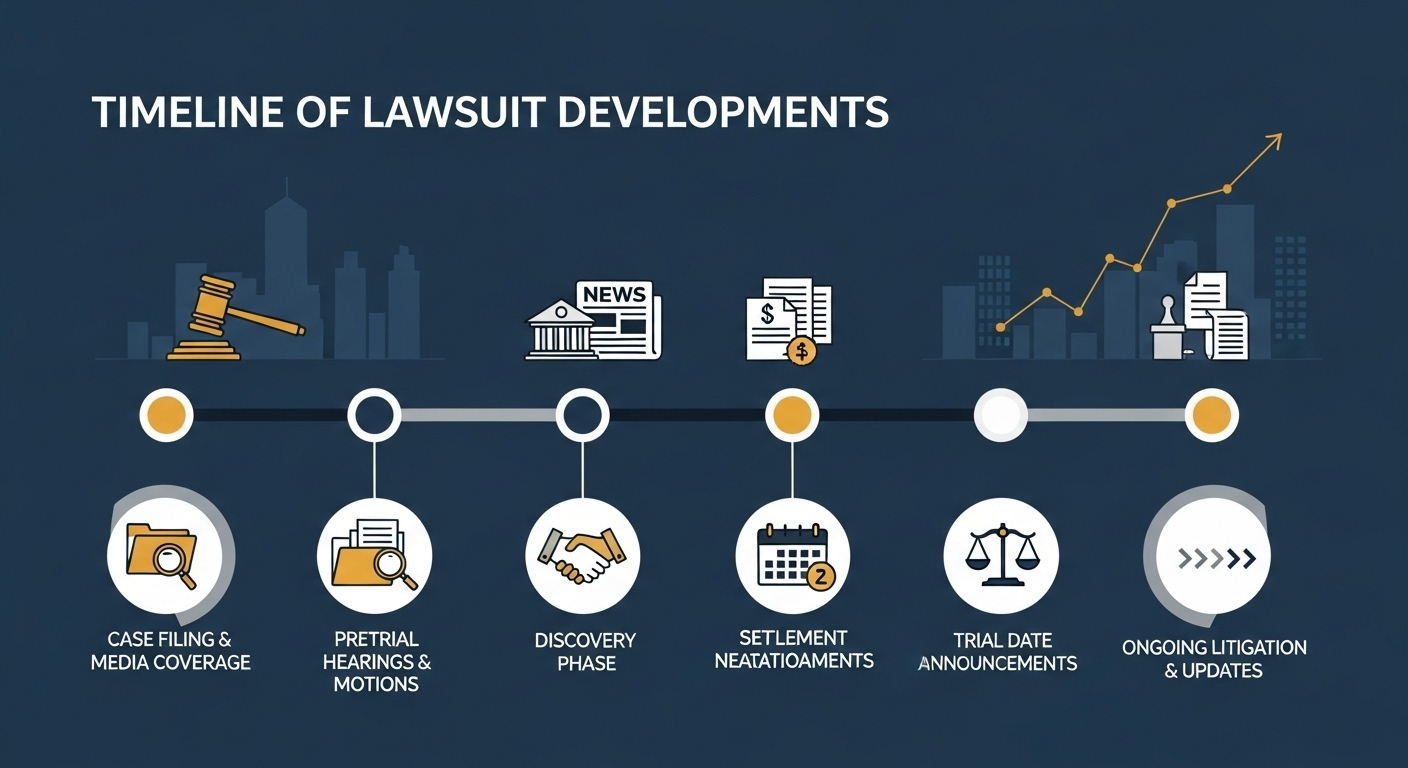

The Ashcroft Capital lawsuit has gone through several important stages that reveal how the case has evolved over time. For investors, following the lawsuit milestones is critical because it shows not only the legal journey but also the impact on transparency, communication, and trust. Below is a breakdown of the chronological case updates and lawsuit progress reports so far.

Case Filing Dates and Early Media Coverage

The lawsuit officially began with its legal filing history, when a group of investors brought forward complaints about returns, disclosures, and communication. The case filing date was closely followed by a surge in media coverage timeline reports, with financial publications and real estate outlets highlighting the seriousness of the claims. Early on, this stage set the tone for ongoing litigation and brought investor attention to the possibility of wider industry implications.

Pretrial Hearings and Motions

After the filing, the court moved into pretrial hearings where lawyers presented motion filings and debated whether some parts of the lawsuit should be dismissed. These early hearings were important because they tested the strength of both sides’ arguments. For many investors, lawsuit progress reports from this stage helped them gauge whether the case had a solid foundation or if it could be thrown out before reaching trial.

Discovery Phase and Court Documents

The discovery phase became one of the most crucial parts of the Ashcroft Capital lawsuit. During this time, lawyers exchanged court documents, financial records, and investor communications to verify claims and defenses. Investors paid close attention to these updates because they offered the first real look at what was happening behind closed doors. For example, missing disclosures or internal emails revealed during discovery could either strengthen investor claims or support the firm’s rebuttal.

Settlement Negotiation Phases

As with most large cases, there were attempts at settlement negotiation phases. While the details were kept private, reports suggest that both parties explored whether resolving the dispute outside of court would be beneficial. For investors, these discussions created uncertainty. On one hand, a settlement could bring quicker compensation; on the other, it might mean limited accountability if the firm didn’t have to admit wrongdoing.

Trial Date Announcements

The lawsuit has also gone through trial date announcements, marking a turning point in the legal battle. Knowing the official timeline for when the case would be heard in court provided clarity for investors and helped them prepare for possible outcomes. These announcements also drew further media coverage timeline attention, making the case more visible across the broader real estate investment community.

Ongoing Litigation and Investor Updates

Currently, the lawsuit remains in the ongoing litigation phase, with continued hearings and updates being shared. Investors receive direct investor updates either through legal representatives or through media outlets reporting on the case. These chronological case updates keep limited partners informed about progress, whether it’s new evidence submitted, motions approved, or scheduling adjustments.

Ashcroft Capital’s Response and Legal Strategy

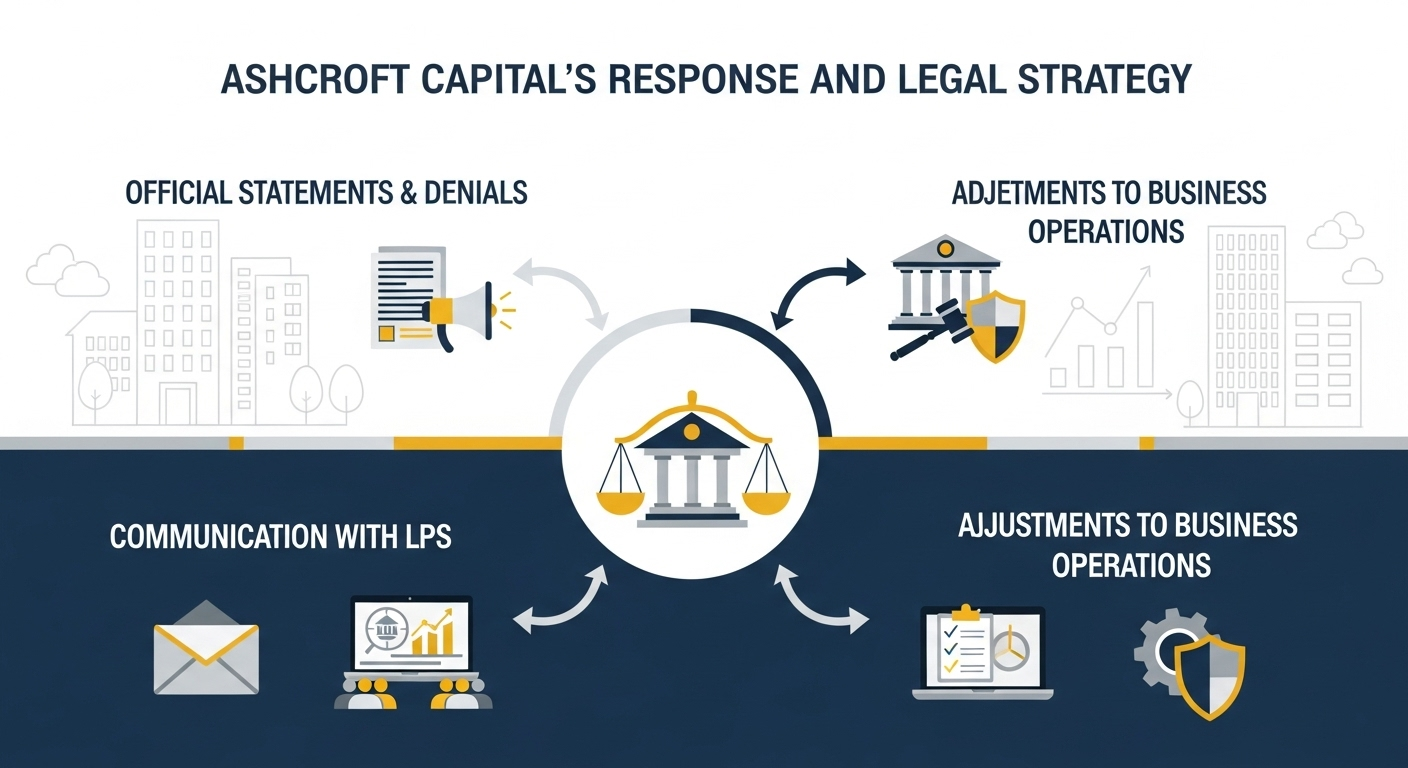

While the Ashcroft Capital lawsuit raised major concerns in the real estate investment community, the company has worked actively to defend its reputation and legal standing. Its response combines official statements, courtroom strategies, and direct communication with limited partners (LPs), along with adjustments to how it runs its business. Together, these actions form a roadmap of how Ashcroft is handling both legal and investor pressures.

Official Statements and Denials

From the start, Ashcroft issued multiple press releases and company statements addressing the allegations. These public denials emphasized that the firm stands by its track record in multifamily syndication and denied any intentional wrongdoing. The tone of these statements shows clear damage control efforts, aiming to reassure current and future investors.

For example, Ashcroft highlighted its history of managing private equity real estate funds and reminded stakeholders that returns in the real estate syndication market can vary due to external factors such as interest rates and property valuations. This messaging strategy reflects the firm’s attempt to maintain credibility while under regulatory scrutiny of investment firms.

Defense Tactics in Court

Inside the courtroom, the firm’s lawyers pursued traditional legal arguments including motion filings and dismissal requests. These courtroom defense strategies are meant to challenge the validity of investor claims and limit liability. By filing counterclaims and emphasizing the burden of proof, Ashcroft is working to shift the narrative from alleged misconduct to investor risk assumptions.

This type of litigation defense playbook is common in investment firm litigation, where sponsors argue that projected returns are never guaranteed. The outcome of these strategies could determine whether the case advances to trial or reaches a negotiated settlement.

Communication with Limited Partners (LPs)

Beyond the courtroom, Ashcroft has made efforts in investor relations through direct LP updates and investor briefings. Regular emails, investor webinars, and private communications were reportedly shared to manage concerns. These updates are designed to provide investor reassurance, but some LPs argue that the communication has been too reactive rather than proactive.

For limited partners, this stage is about rebuilding trust. Timely stakeholder updates and open dialogue can reduce the breakdown in trust that lawsuits often create. In forums like BiggerPockets and WSO, some investors acknowledged these updates while others questioned whether they were detailed enough to truly address concerns.

Adjustments to Business Operations

In response to investor concerns and the lawsuit, Ashcroft reportedly made operational changes and initiated internal audits. These restructuring strategies include revisiting how fees are structured, improving compliance improvements, and adding new risk management updates.

For example, the company began implementing stronger reporting systems to ensure investor protection measures are front and center. Such adjustments are not only about addressing the current limited partners dispute but also about positioning the firm to continue raising funds in a cautious market.

Investor Reactions and Community Sentiment

The Ashcroft Capital lawsuit hasn’t just played out in courtrooms. Its impact is strongly felt among investors who worry about how it affects their money, future payouts, and trust in the company. From concerns about transparency and capital calls to heated debates on online investor communities, the case has created mixed reactions that shed light on how sensitive investor confidence can be in the real estate syndication market.

Concerns on Transparency and Capital Calls

One of the biggest issues raised by limited partners has been the handling of paused distributions and unexpected capital calls. Some investors expressed frustration when scheduled payouts were suspended without clear explanations. This fueled concerns about cash flow and created fears around liquidity worries.

When distribution suspensions happen, investors often feel blindsided, especially if they believe the sponsor hasn’t been upfront. In this case, the uncertainty over payouts led to widespread investor dissatisfaction. Many questioned whether funds were being managed responsibly or if money was being redirected to cover legal and operational costs instead of investor returns.

Forum Discussions (Reddit, BiggerPockets, WSO)

The lawsuit has become a hot topic across financial forums and real estate syndication groups. On Reddit threads, investors openly debated whether they should stay in Ashcroft’s deals or exit future ones. Over at BiggerPockets forums, members dissected the firm’s track record, raising questions about due diligence and whether other syndicators might face similar scrutiny.

On Wall Street Oasis discussions (WSO), the tone was more analytical, with contributors comparing this case to previous investor lawsuits in real estate. The volume of social media debates shows how quickly trust issues can spread in the age of crowd opinions and instant communication. These discussions amplify both positive and negative sentiment, making it harder for Ashcroft to control its narrative.

Impact on Reputation and Fundraising Ability

Perhaps the most significant consequence of the Ashcroft Capital lawsuit is its effect on reputation. Allegations of mismanagement have triggered trust erosion, leading to investor hesitancy and, in some cases, limited partner withdrawals from upcoming projects. Even investors not directly involved in the case have become cautious about committing funds.

This reputation hit translates into a fundraising slowdown, as new deals face delays or reduced interest. In private equity real estate, where credibility is everything, reputation management issues can make or break future growth. For Ashcroft, the difficulty raising new funds reflects how quickly loss of goodwill spreads when transparency is questioned.

Potential Lawsuit Outcomes and Payout Scenarios

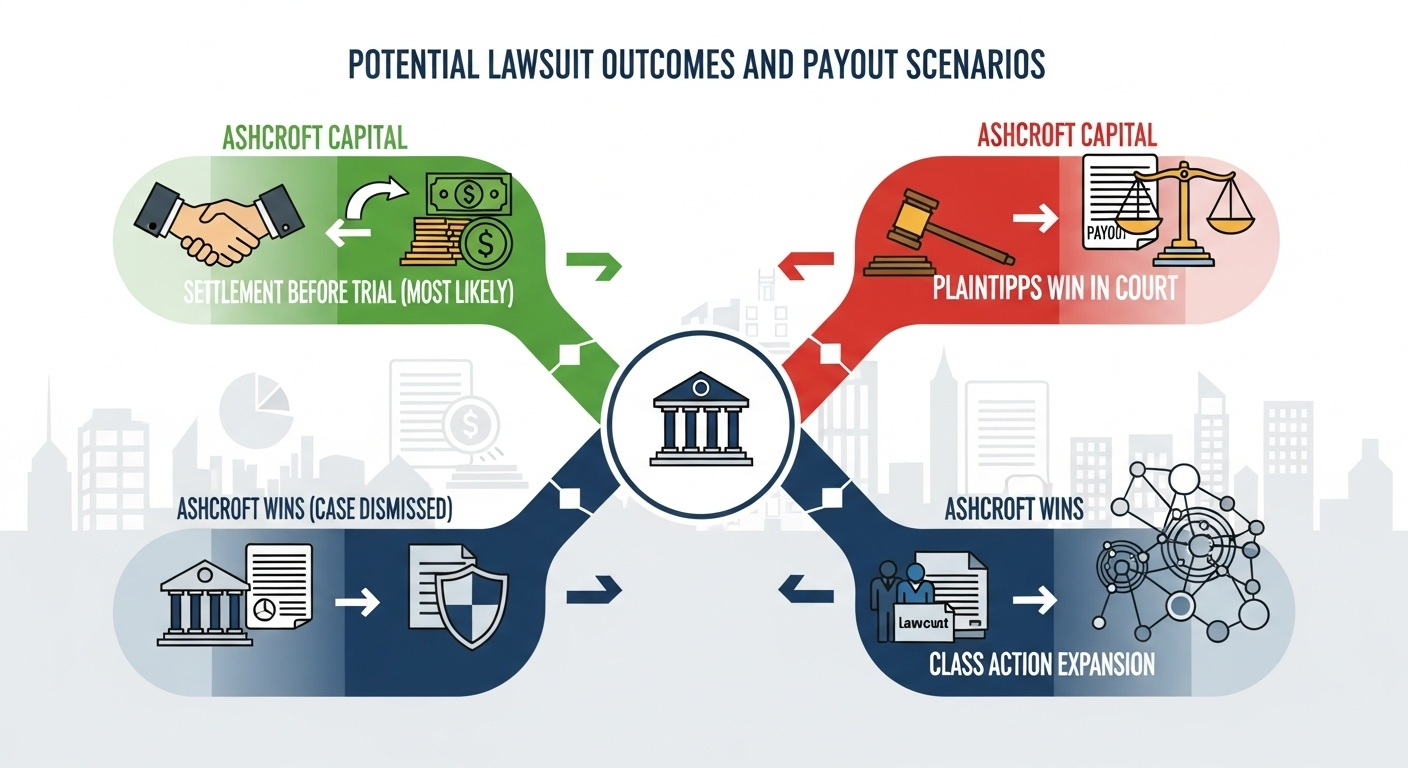

Every investor following the Ashcroft Capital lawsuit wants to know the most important question: what happens next? While no one can predict the exact outcome, legal experts generally point to four possible paths. Each one carries very different consequences for limited partners and the broader real estate investment community.

Settlement Before Trial (Most Likely)

The most common outcome in cases like this is a negotiated settlement. Both sides often prefer to resolve disputes through legal mediation rather than risk a long and expensive trial. A financial compromise could mean investors receive some form of payout agreement, while Ashcroft avoids admitting wrongdoing.

For investors, this scenario offers quicker relief compared to waiting years for a verdict. It also reduces the uncertainty that comes with drawn-out litigation. In practice, many settlement negotiations are private, but the general goal is clear: provide investor compensation deals while avoiding trial costs that drain both sides.

Plaintiffs Win in Court

If the plaintiffs succeed, a favorable verdict would result in damages awarded and possibly a precedent-setting case for other investor lawsuits in real estate. In this outcome, a court judgment could mandate significant compensation for investors, depending on how much loss is proven.

A trial outcome favoring plaintiffs would likely highlight issues such as misrepresented returns, withheld financial disclosures, or fee disputes. For investors, this would mean a clear judicial ruling that validates their claims and forces Ashcroft to pay. However, the process would be lengthy, with appeals possibly extending the timeline for actual payouts.

Ashcroft Wins (Case Dismissed)

Another possible outcome is that the case is dismissed. If Ashcroft’s legal team succeeds in proving a lack of evidence or wins a dismissal motion, the lawsuit could be thrown out. This defense victory would clear the firm of liability and remove the obligation to compensate investors.

For Ashcroft, a no liability ruling would restore credibility in some circles, but the court of public opinion might still carry doubts. Investors who were expecting payouts would leave empty-handed, and lingering trust erosion could still affect future fundraising efforts.

Possible Class Action Expansion

One of the more complex outcomes is the potential for collective investor lawsuits. If enough investors share similar complaints, they could push for class certification, turning this into a group litigation case. In that scenario, hundreds of investors could join forces in a mass litigation process.

This kind of class action formation would increase pressure on Ashcroft and potentially raise the financial stakes dramatically. While it gives smaller investors more power by pooling resources, it also extends the timeline, as collective legal efforts typically take years to resolve.

Impact on the Real Estate Investment Industry

The Ashcroft Capital lawsuit is more than just a legal battle between a firm and its investors — it has wider implications for the real estate syndication market in the U.S. Many limited partners are already questioning whether this case signals deeper private equity real estate risks. When a well-known sponsor faces allegations, it often creates a ripple effect on syndication trust across the industry.

One major concern is investor trust decline. Real estate syndications rely heavily on confidence between sponsors and investors. If trust erodes, even strong deals may struggle to raise capital. This can push investors toward safer options like REIT competition or other alternative investments with more transparent structures.

Another impact could be regulatory. Cases like this often spark calls for stronger regulation in syndication regulations and private offerings. Policymakers and agencies such as the SEC may push for tighter oversight, stricter disclosure requirements, or more consistent reporting standards. While these changes could increase compliance costs for firms, they may also improve industry credibility in the long run.

Fundraising is also at risk. Sponsors facing lawsuits often experience an effect on capital raising, as both new and existing investors hesitate to commit. For example, industry reports have shown that after high-profile disputes, capital commitments to syndications dropped temporarily while investors shifted focus to institutional deals.

What Investors Should Do Now

For many limited partners, the question isn’t just what the courts will decide — it’s how to protect themselves today. Here are practical steps investors can take:

Stay Updated on Case Progress

Investors should actively track lawsuit alerts and litigation reports to stay informed. Subscribing to legal news tracking platforms or following case monitoring updates ensures you don’t miss important developments. This way, you can make better decisions as court updates and settlement talks unfold.

Consult Legal or Financial Advisors

If you’re directly affected by the Ashcroft Capital lawsuit, consider speaking with investor protection lawyers or securities attorneys. They can provide professional guidance on your rights and potential recovery options. Even if you’re not involved, a financial consultant can help you evaluate your portfolio for exposure to similar risks.

Review PPMs and Fee Structures Carefully

Every investor should go back and review their Private Placement Memorandum (PPM) and offering documents. Look closely at sponsor fee analysis, contract obligations, and how distributions are structured. Many disputes start with hidden charges or misunderstood performance fees. Practicing this level of due diligence now can prevent future issues.

Diversify Across Sponsors, Not Just Deals

One of the most important takeaways is to avoid overexposure to a single sponsor. Practicing risk diversification by spreading your capital across multiple operators can reduce concentration risk. Instead of just diversifying deals within one sponsor, consider a multiple sponsor strategy for stronger portfolio risk management.

Lessons Learned from the Ashcroft Case

The Ashcroft Capital lawsuit offers more than just a legal dispute—it delivers valuable lessons that every investor in real estate syndications should pay attention to. At its core, this case highlights the importance of investor due diligence, the role of ethical sponsors, and the need for greater risk awareness in private equity real estate deals.

One key takeaway is that investors must dig deeper into the communication practices of sponsors. Many disputes in syndication stem from unclear updates, hidden risks, or lack of transparency lessons. If investors had more consistent and clear communication, trust would be easier to maintain even during challenges. This lawsuit shows why reviewing track records and understanding how sponsors handle setbacks is as critical as analyzing projected returns.

Another lesson is around risk awareness. No investment is risk-free, but some risks are avoidable when you ask the right questions early on. For instance, reading offering documents thoroughly and checking alignment between fees and investor returns can reveal red flags. In short, investors must apply best practices in real estate investing, not just rely on marketing presentations.

Finally, the case reminds us of the value of choosing ethical sponsors who put investor interests first. Deals may look attractive on paper, but the sponsor’s integrity determines long-term results. By focusing on improving investment decisions and avoiding future risks, investors can protect themselves against scenarios similar to this one.

FAQs on the Ashcroft Capital Lawsuit

What is the lawsuit about?

At its core, the lawsuit concerns allegations around sponsor practices, investor communication, and deal structures. While every case is unique, this one raises issues tied to syndication impact and investor protections.

How long will the case last?

It’s difficult to predict the case duration. Lawsuits involving multiple investors and complex financial arrangements can take months or even years, depending on whether the matter is settled early or proceeds to trial.

Will investors receive payouts?

The outcome depends on how the court or settlement process unfolds. Some scenarios may involve investor payouts through negotiated agreements, while others may result in no financial recovery if the case is dismissed.

How does it affect current returns?

For investors already involved in Ashcroft deals, the lawsuit may cause uncertainty. While not all projects are directly impacted, concerns about how lawsuits affect returns can create stress for those waiting on distributions.

What does this mean for the industry?

The lawsuit may prompt broader discussions about syndication impact, including tighter oversight, stronger disclosure requirements, and greater emphasis on transparency. In other words, it could reshape broader market impact and investor expectations going forward.

Conclusion

The Ashcroft Capital lawsuit is more than just a legal battle—it’s a reminder of how important transparency, due diligence, and sponsor integrity are in real estate investing. For investors, the case highlights the need to carefully evaluate sponsors, read offering documents closely, and diversify wisely. While the outcome is still uncertain, the lessons it provides can help shape a stronger future investment outlook for everyone involved in syndications.

Rebuilding long-term investor trust will depend on clear communication and ethical practices, not just attractive returns. Limited partners should consider their next steps for LPs carefully—whether that means consulting advisors, reviewing fee structures, or spreading investments across multiple sponsors. For the broader market, the lawsuit may influence the future of real estate syndication, with regulators and investors alike pushing for more accountability and oversight.

Ultimately, the case offers important lessons for sponsors too. Those who prioritize investor interests, act ethically, and embrace transparency will stand out in an industry that is bound to face industry adjustments ahead.

For investors, the takeaway is simple: learn from this case, strengthen your strategies, and stay prepared for the future of real estate investing.